Overdraft Coverage

Overdraft Coverage Options

Life happens! USPS FCU understands that unexpected overdrafts occur from time to time - Overdraft Coverage can help.

The choice is yours. Consider these ways to cover overdrafts:

Services

-

Overdraft Protection Link to Another Deposit Account (Ex. Savings) - $2 fee per transfer1

-

Overdraft Protection Line of Credit - Subject to interest2

-

Overdraft Privilege - $30 Overdraft fee per item presented*

*Per item presented means each time an item is presented, including representment.

Overdraft Protection services apply to all transactions and may help prevent overdrafts by automatically transferring funds to your checking account from another account or line of credit you may have at U. S. Postal Service FCU for a finance charge. Please note that overdraft lines of credit are subject to credit approval.

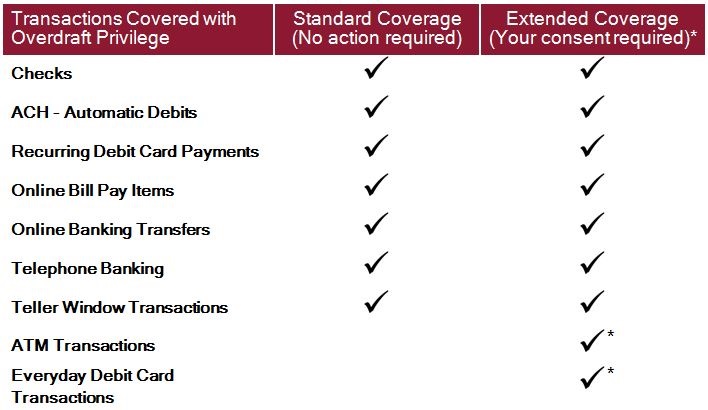

Overdraft Privilege allows you to overdraw your account up to the disclosed limit for a fee in order to pay a transaction. Even if you have overdraft protection, Overdraft Privilege is still available as secondary coverage if the other protection source is exhausted. Please contact us at 800-877-7328 for other important information about Overdraft Privilege.

Which coverage is best for you?

If you would like to select Extended Coverage for future transactions, you will need to do one of the following:

- Complete this online consent form, then fax it to 301-856-4061

- call us at 800-877-7328

- visit any of our branch locations

- mail your completed form to us at: 7905 Malcolm Road, Suite 311 Clinton, MD 20735

- email us at uspsfcu@uspsfcu.org

*You can discontinue the Overdraft Privilege in its entirety by clicking here and completing this form and then mail it to 7905 Malcolm Road

Suite 311, Clinton, MD 20735-1730, fax it to 301-856-4061, or email it to uspsfcu@uspsfcu.org.

1To select your overdraft transfer options, call us at 800-877-7328, email us at uspsfcu@uspsfcu.org, or come by a branch to sign up or apply for these services; 2Subject to credit approval.

Overdraft Disclosure: 1A fee will be imposed for overdrafts created by checks, ACH, Point-of-Sale, ATM withdrawals, in-person withdrawals, or by other electronic means.2Overdraft balances must be covered within 32 days. 3An overdraft will not be paid if the available balance, including Overdraft Privilege limits, is insufficient to cover the item.